The last week has truly been one of the darkest in the history of our beautiful country. Words fail us and it is difficult to come to grips with what is really playing out, especially in KwaZulu-Natal which is the province worst affected by the scenes of looting and utter destruction that occurred.

Despite all the heartache, there are also stories of hope. It was encouraging to see communities, made up of all races, getting together to protect what is so dear to them. Civilians heading back to the ‘war-torn’ streets to start the clean-up process and good Samaritans who risked their own safety to transport food from Gauteng and other provinces to areas in KZN without any food. That to me is the real South-Africa, a majority that still cares for its fellow citizens. It reminds me of the now famous meme:

“TOUGH TIMES DON’T LAST FOREVER, TOUGH PEOPLE DO”

It is understandable that in uncertain times like we are facing now, our clients will also be concerned about their investments.

It’s important to make the distinction that what happens on the streets doesn’t always translate directly into markets. That especially holds true for our local market. Roughly 70% of the JSE Top 40 earnings are derived offshore and thus the market is predominantly driven by global factors rather than domestic headlines.

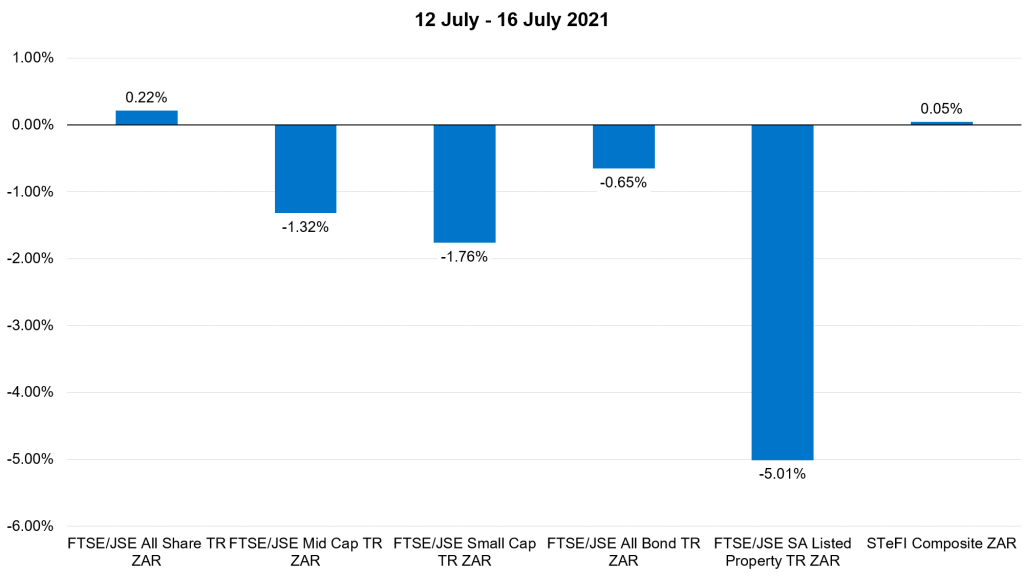

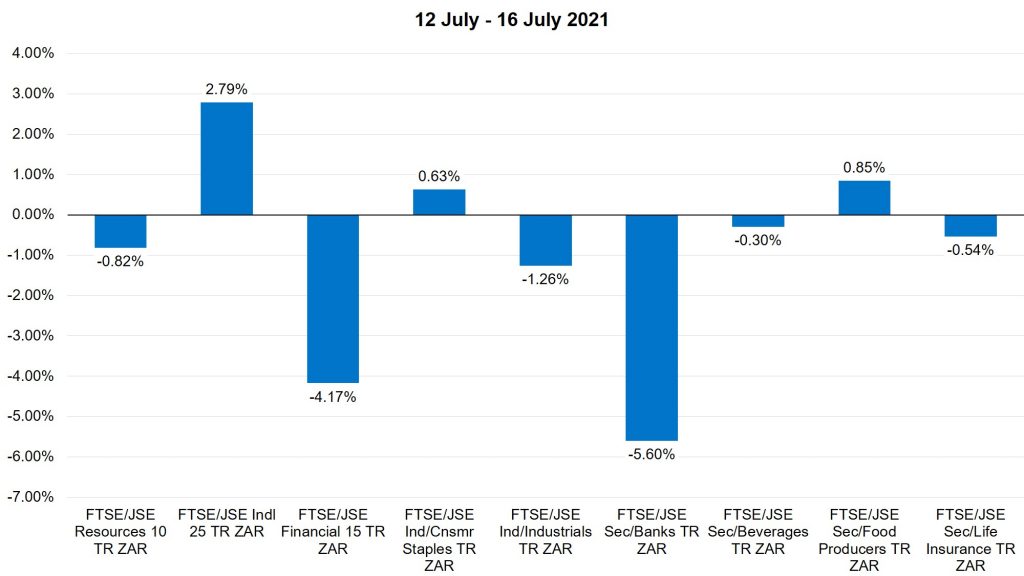

With the Rand hedges dominating the Index, the Rand also serves as a shock absorber and we’ve seen it weaken materially over the last week – albeit after a good run. The JSE All Share was up 0.22% over the week ending 16 July 2021, aided by the weaker currency, with the SA Inc stocks (banks and retailers) the hardest hit. Just to display graphically, the charts below depict how the various local asset classes performed over this week as well as the broad sectors and then which sub-sectors were worst affected.

Graph.1 Local Asset Class Performance (12 July 2021 – 16 July 2021)

Source: MorningStar, July 2021, Local Asset Classes

Graph.2 Broad JSE Sector Performance and Sub-sectors affected

Source: MorningStar, July 2021, Broad & Sub-Sectors

If you consider which business sectors have been affected by this unrest (and not to minimise the impact on our collective emotions and the effects on real people’s lives – just focusing on investments in the portfolios) – in the large majority of cases it has been retail outlets and small shopping malls, with industrial warehouses, factories and logistic companies having been affected too. They are almost entirely businesses that are unlisted. So what proportion of the JSE has been directly affected? The proportion thereof will be very small.

Then there are the wider macroeconomic implications of this in terms of business and investor sentiment, as well as an impetus for a potential further brain drain from SA, and the potential impact on foreign direct investment. There will clearly be negative short-term effects on these, but whether these become longer term issues remains to be seen. We’ll need to wait and see how quickly this is brought under control, but I must say that there are encouraging signs thus far.

The globally focused counters on the JSE will benefit from this as the Rand weakens, and if you look at the top 10 holdings in most portfolios they include stocks like British American Tobacco, BHP Billiton, Naspers, PGM & Gold miners etc. with underweight exposures to SA Inc. stocks, so our portfolios are well positioned for this. We also increased offshore exposure in the portfolios, to close to the maximum allowable weight during the last round of investment committee meetings, and so this weakening of the Rand will also add to portfolio returns coming from that exposure.

We do think residential property values may be affected in certain areas, but again this is not something that we have large exposure to in portfolios. We are underweight local listed property in the portfolios, so this would also have been the right positioning, given the current environment.

In the SA bond market, the government fiscus is looking much healthier than it was a year ago, with tax revenues much higher than was budgeted for, and government expenses coming in a lot lower, so we expect that the rating agencies will not downgrade SA bonds later this year. With the yield curve as steep as it is currently, we do expect that as things calm down, long term bond yields will start to come down and should benefit investors.

At this stage we are confident in the current positioning of the JBL Funds of Funds. We are in constant communication with underlying managers and will also rely on them to make the right calls on behalf of our clients. Some managers have already started to make shifts to specific shares within the portfolios where necessary, to make sure they have underweight exposures to affected segments of the market should a resolution to this drag on or in the event that things deteriorate further.

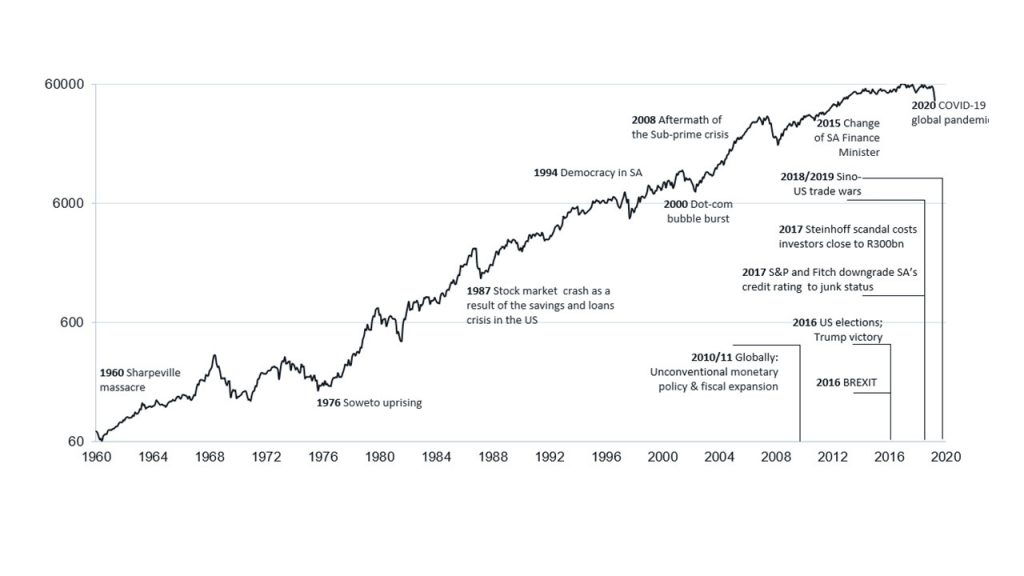

We are keeping a close eye on the economy and will certainly update our Tactical Asset Allocation should any of our shorter-term views change but typically for any investor the best option is to stay the course – particularly when the noise is loudest. Longer term implications for SA (and particularly smaller business in SA) will also need to be monitored and managed given a Covid-induced hangover and the undeniable damage of the last few days. That said, if one reviews the history of our market and the economy, there have been moments of heightened anxiety and market volatility and the net result has almost always been that investors have made money.

Source: IRESS, FTSE/JSE All Share closing values

South Africa is still fighting the Covid pandemic, with the Delta variant proving to be resilient and extremely dangerous. With the large drawdowns of February/March last year still fresh in our minds, let us not forget the damage that emotional decisions can also have on portfolios.

I’d like to encourage clients to stay the course, trust in our processes and remember that rational thinking should drive one’s investment decisions. This is all too easy to forget when emotions are running high.

The JBL Team

JBL Wealth

All author postsRelated Posts

September 2024 Economic Review

16 Oct 2024

0 Comments1 Minute

Read this article on the Graviton Perspectives website. Click here.

How Millennials and Gen Z are reshaping the future of sustainable investing

14 Oct 2024

0 Comments1 Minute

Read this article on the Graviton Perspectives website. Click here.

Monthly Market Highlights – August 2024

9 Sep 2024

0 Comments1 Minute

Read this article on the Graviton Perspectives website. Click here.